Crunching the stats: what the budget means for Hackney residents

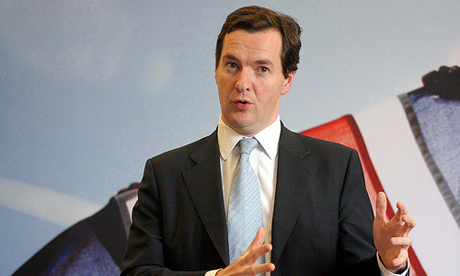

Chancellor George Osborne announced the coalition government's emergency budget today. Photo: © altogetherfool

Presenting the coalition government’s emergency budget, George Osborne said, “we’re all in this together”. But are boroughs like Hackney paying more than their fair share?

With VAT up to 20 per cent, housing benefit cut and child benefit frozen along with public sector pay, poorer parts of the country and areas with high levels of public sector employment look set to pay for the mistakes and excess of the City.

Trade unions and charities had campaigned for each budget proposal to be subjected to a “fairness test” to assess who would bear the burden of tax rises or spending cuts. But many of the measures introduced in the budget failed the test as they penalise the poorest.

The rise in VAT, for example, is the most regressive of tax rises, as it hits the poor hardest. The Equality Trust estimate that the richest families spend just seven per cent of their disposable income on VAT, while the poorest spend almost double.

Hackney is the most deprived borough in London (p.7) and is second only to Liverpool as the most deprived in the country. And inner London remains the most unequal part of the country with a fifth of its residents amongst the richest tenth of households in the country. There is little evidence to suggest this budget will close the gap.

Changing the way increases to benefits are calculated (from retail price index to consumer price inflation) will increase income inequality as those on benefits at the bottom fall further behind those earning.

The change is bad news for the 39,000 in Hackney who claim housing or council tax benefit and the 57,000 children who receive child benefit, and anyone with a public sector pension (although state pensions are excluded from the change).

46,000 children in Hackney receive tax credits – to be cut for any family with a total combined income over £40,000 a year. Average household income in Hackney is lower than £40,000 but the cut will have a huge impact for those families where, to take an easy example, two parents each earn £20,000 a year.

Hackney’s 23,000 public sector employees stand to lose out from the two-year pay freeze, affecting almost one in three Hackney workers, compared to one in five nationally.

Lifting the income tax threshold means some on low pay will no longer have to pay income tax at all. But the poorest – pensioners, the sick, the unemployed and low paid part-time workers – will not be helped and will be hammered by the VAT hike.

Will the levy on banks and rise in capital gains tax for higher tax payers be enough to convince those at the bottom that those at the top are paying their way too? If not, the budget has certainly failed the fairness test.

I have to wonder how much of the panic at this budget is genuine and how much is “oh my god it’s not Labour”. Considering that the press have revealed that Labour planned to cut £44 billion from the budget this year, it probably differs more in style than substance from what Labour would have done were they still in power rather than carping from the sidelines at the measures necessary to get us out of the mess in which they landed us.

The cut in income tax will do far more to help Hackney’s poorest families than the VAT rise (which I am admittedly disappointed by) will hinder them. VAT is a tax on “luxury” items and it is pretty easy to avoid. My last ASDA receipt tells me that I paid 40 pence in VAT on a thirty quid shop last week as almost all staples are exempt. The rise in VAT would make that 44p whilst I would have paid about £4 less tax this week. Nonetheless, VAT is by its nature regressive as it taxes those who have to spend their income more than those who can afford to save.

I am reassured by the concessions in the budget to the Liberal Democrats – higher tax on capital gains (a tax on the rich if there ever were one), fewer benefits for those on high incomes and the hike in the personal allowance. I am also pleased to see real moves to help create jobs in real business even if they will help areas outside London more in the short term.

What we need to see now is a move towards more anti-avoidance legislation to make sure the rich can’t wheedle out of paying the tax they owe. I am sick and tired of people complaining about “benefits scroungers” when the really big scroungers are the rich who “plan” their way out of paying their fair share through dubious but legal schemes which, according to the Guardian (Apr 13th) cost the government £13 billion last year.

Hi Reuben,

[….]

Just a couple of points:

The recession was caused by international reckless lending and legalised fraud by banks. This has reduced tax receipts and lead to massive public spending in the form of bail-outs. But it’s a fallacy to suggest that we’re in a mess because of government spending.

Yes, raising the income tax threshold will help some but more than half the population don’t earn even enough to pay income tax. It is these people who will be hit by VAT rises, benefit freezes and the 25% cut in public spending.

On capital gains tax, only 130,000 people pay. The rise, along with the £2bn bank levy, will hardly be notcied by the super-rich. Corporation tax has just been cut to the lowest rate in the western world.

The fact remains: public sector workers, those on benefits for whom there is no work available, and anyone on a low or middle income will be paying for a crisis they had no hand in creating.

Reuben

the Budget Book says in black and white that the Coalition is making £17 billion more cuts a year than the Labour government planned. That is a lot of public services extra being cut. Your party had a political choice between joining a government that would have made fewer cuts, slower and more, faster. There was also a difference in the ratio of cuts vs tax rises to tackle the recession proposed by Labour (33-66) and the Tories (20-80) which has added to the scale of the cuts. There was also a choice between the VAT increase or more progressive taxation. For whatever reason, you chose the fast cuts,more cuts, more regressive VAT route.

I reject your suggestion that Labour’s spending was a “mess”. The “mess” was an international banking crisis. Spending and borrowing to reflate the economy and get growth going again was a sensible Keynesian solution, not the actual problem.

Luke

Luke,

London in the biggest banking centre in the world and is regulated by – hang on – wait a minute – THE BRITISH GOVERNMENT – which was Labour. So don’t try blaming mysterious “international” elements or you’ll end up sounding like a nervous Breshnev.

And as for the choices we faced – they were between

a) Letting the Tories do what they want

b) Keeping them at least partially under control.

I’m pleased we went with b – that’s why they didn’t get to raise the inheritance tax threshold to several million quid.

Option c was never on the cards as the wreckers of the Balls-up faction made certain of that as soon as Brown failed to secure a majority.

Out of interest, why are they “cuts” when someone else makes them, but “efficiency savings” when Jules does?

[…] surely it’s right that the top 130,000 people end up paying? I’d dispute the figure, but am quite happy with the concept.

Hi Reuben

The point is that 130,000 people isn’t a right lot. And at just 28% it’s not going to raise very much. A token guesture really and an insignificant one when set against the rest of the measures which hit the poor far more than anyone else.

One question: is it right that £13bn is being raised by putting up VAT; £11bn by cutting welfare yet only £2bn through the bank levy?

we could say that the crisis was caused by reckless borrowing – it takes two to tango.

Except in the UK it was a secondary effect following the crisis in the US. In general the quality of loans was better. The UK crisis was triggered as the short term money dried up internationally on the back of percieved credit risk. Then the weaker banking models in the UK hit the wall. And then there was no money for trade finance, working capital, remortgaging etc

If the banking levy were double it would be incorporated into the banks costs and passed on – so not that effective really.

But this debate is about how much do you take from those who work in productive/profitable jobs to give to those who dont, especially wwhen those producing are in increasinglyconstrained circumstances.

The budget does not take from the poor at all – it just gives them less.

shouldnt there be enquiries into who spent what and where and drag those respnsible across the coals like they did to dr.kelly.But that wont happen dr.kelly wasnt a minister.