Divest Hackney ‘alarmed’ as data suggests rise in fossil fuel investments

Invested: campaigners outside Hackney Town Hall earlier this year. Photograph: Divest Hackney

A new report suggesting Hackney Council’s fossil fuel investments are “going up” has alarmed green campaigners – but the Town Hall says it is “not accurate”.

In January, the council pledged to cut its pension fund’s fossil fuel stocks by 50 per cent over the next six years, following a campaign by Divest Hackney.

But a new report by national pressure group Go Fossil Free, called Fuelling the Fire, estimates that the council’s current investments sit at £67 million – a £25 million increase since 2015.

Hackney Council said the figure appears to be based on data from 2016 and is “not accurate”, but it is “working on supplying the correct figures imminently”.

Divest Hackney’s Gabriel Davalos described Go Fossil Free’s report as “alarming”.

He said: “The figure suggests fund managers are not actively decreasing Hackney’s investments in fossil fuel companies.

“We would like to see the number going down – ultimately to zero – so it is alarming that it appears to be going up.”

A Hackney Council Spokesperson said: “The figure provided by Go Fossil Free appears to be an estimate based on the council’s pension fund vales from March 2016, therefore is not accurate.

“We are working on supplying the correct data imminently. Additionally, we now plan to publish an annual breakdown of investments with the Pension Fund’s Report and Accounts, with the 2016/17 accounts due to be published by December 2017.”

Divest Hackney said the council has failed to respond to a Freedom of Information request for up-to-date figures that it submitted in June.

The group campaigned for three years before the Town Hall committed in January to divesting half of its fossil fuel stocks by 2023.

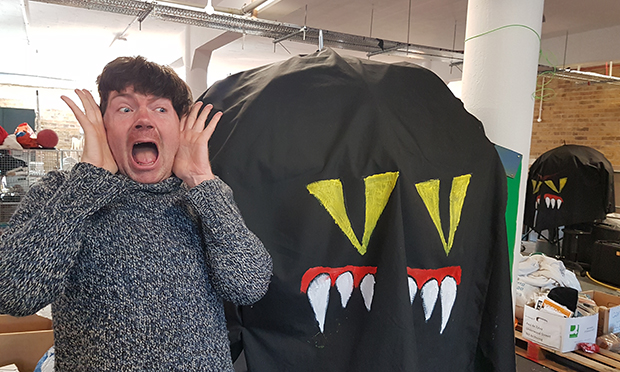

On emission: campaigners chased a fossil fuel monster through Hackney in May. Photograph: Divest Hackney

Members have staged further protests since that announcement was made, including chasing a “fossil fuel monster” out of the borough, to call for 100 per cent divestment.

Local campaigner Camilla Zerr said: “The minimal risk of lower returns caused by removing investments from fossil fuels are in no way comparable to the huge and extensive risks associated with the disastrous impacts of climate breakdown on human livelihoods and the environment – impacts which we are seeing right now.

“How many more storms like Ophelia and hurricanes like Harvey do we need to make the urgency of the climate crisis hit home?

“Divesting 100 per cent is the only commitment that matches the scale of the issue. And it needs to be done now – not in six years.

“The fact that Hackney Council continues to invest in the companies responsible for the crisis flies in the face of the Paris Agreement and of all the efforts being made locally to reduce emissions and combat climate breakdown.

“It’s shocking to see our council investing so significantly in such a financially risky and morally bankrupt industry.”

Last month, the council defended its pension fund’s £27 million investment in tobacco companies, despite encouraging residents to quit for StopTober.

Cllr Robert Chapman, chair of the Town Hall’s Pension Committee, said: “Hackney Council has a strategy to reduce its pension fund’s exposure to fossil fuel investments. The fund’s long-term ambition is to move away from fossil fuel investments, and I can foresee a time when our fund will have no fossil fuel investments.

“Our ambitious target to reduce the fund’s exposure to future CO2 emissions by 50% is the first step on that journey, this aims to bring us into line with the 2% international Paris Agreement scenario. This implementation will be monitored by an independent analysis over the next three years.

“However, we must ensure that any changes to how the Hackney Pension Fund is managed are taken extremely carefully. Our first responsibility is towards those whose pensions we manage as well as other stakeholders, which include local Council taxpayers.

“We have to ensure that the pension fund receives the best returns possible, and also comply with the various legal duties associated with managing a large pension fund.”

A Hackney Council spokesperson said: “As of 30 September 2017, the council currently held approximately £26.5m in direct equity holdings in oil and gas companies. It had exposure via pooled investment funds to a further £41.2m of underlying holdings in energy producers. This represents approximately 4.7% of the value of the Fund.

“The figure of £67m provided by Fossil Free UK is an estimate based on 2015/16 accounting data, using the assumption that 10 per cent of all the Fund’s equity mandates are invested in fossil fuel stocks.

“Whilst this is very close to the current true figure (when indirect investments are included), it should be noted that the level of investment in fossil fuels is not evenly distributed across the Fund’s mandates, with indirect investment accounting for significantly more of the Fund’s fossil fuel exposure relative to mandate size.”

Update: this article was amended at 15:06 on Tuesday 21 November 2017 to include a comment from Cllr Robert Chapman, as well as a further comment from Hackney Council providing the most up-to-date figures.